Der deutsche Text in diesem Post ist nach dem Link:

Read the rest of this entry »

As described in the last german TAX post I was trying to get information about german income taxes, in particular I wanted to get the concrete formulas. I asked via fragdenstaat.org at the Federal Agency for Civic Education (Bundeszentrale für politische Bildung: BPB) for that information, since they have a webpage about income taxes. This page however cited only a little phrase, with the names of the different income zones before I wrote the letter, but luckily it got meanwhile at least a little revamped. However the page still doesn’t show the formulas, moreover it is not very up-to-date. In addition the BPB was not only not able to help me with my request, but I was told that:

” In Bezug auf weitere steuerrechtliche Auskünfte bitte ich Sie, von Anfragen bei der bpb Abstand zu nehmen, weil wir definitiv nicht dafür zuständig sind.”

(translation without guarantee: with regard to further tax law requests I ask you to precind from sending further requests to BPB, because we are definitly not in charge for this.)

I should maybe also mention that I asked a representative of the ministry of economics for the formulas, who said I should ask a tax consultant.

As already said in the comment at fragdenstaat.de I had then finally found formulas for the taxes 2010-2012 (after a long search). The formulas are on the site of the ministry for finance with the taxcalculator and you can get the formulas if you type in any income, and then hit the button “BERECHNEN”. I couldnt however find the formulas for the original draft for the taxes for 2013 from February last year, neither the formulas for the new draft as of december 12 last year for the taxes for 2013. Mr. Liebig, who runs the website www.lohn-info.de had however found them and had included the numbers on his site, so I wrote him an email and asked him for the links.

I have meanwhile got an answer from Mr. Liebig who had kindly send me the links via email.

A document which describes the taxes for the upcoming year, as of 121212 is at the website of the Bundesrat.

A document which was the old draft for the 2013 taxes and which was intended to mitigate the impact of higher taxes due to BRACKET CREEP is at

http://dip21.bundestag.de/dip21/btd/17/086/1708683.pdf

I meanwhile included the new numbers into the formulas. Details (in german) and the mathics code can be found after the click.

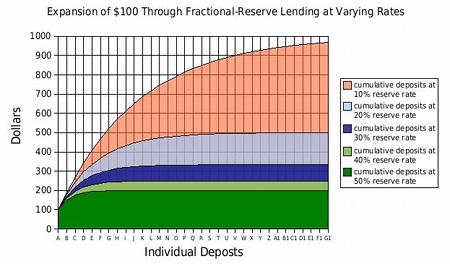

The result in short: If I didn’t miscalculate then there are tax reductions of 8-24 Euros/year for the incomes above 13500 Euros per year. For incomes of 8100 Euro to 13500 Euros there is a tax increase of about 15 Euros/per year. The procentual bracket creep (not sure wether this is called this way, please look at formulas) is for 6% income increase maximaly about 2.5%, for 2% income increase it is about 0.8%.

(more…)