The tragedies of marine towns

December 18th, 2009On monday a study by the Convention on Biological Diversity in collaboration with the UNEP World Conservation Monitoring Centre was released (->press release). The study with the title “Scientific Synthesis of the Impacts of Ocean Acidification on Marine Biodiversity” is a survey on the current results in the investigation of ocean acidity. It is thus a follow-up study to studies initiated e.g. by the global network of science academies (see IAP statement on ocean acidification ) or like the ones which led to the Monaco Declaration.

A main message of these studies and statements is that Carbondioxide i.e CO2 (a major greenhouse gas) has increasingly been taken up by the worlds oceans and thus reduced the effects caused by an increased CO2 level in the athmosphere like e.g. the greenhouse effect. This may on the first sight sound good to climate sceptics since it means that there are processes which act naturally against higher CO2 levels. Unfortunately there are now plenty of measurements which indicate that the uptake of CO2 has been slowing down in the last years, i.e. that it seems that a kind of saturation has been partially/will be reached soon. Due to this the

accumulation of CO2 in the atmosphere may accelerate rather soon.

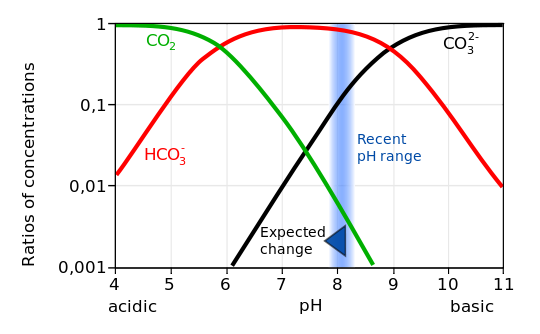

A second main message/problem with this uptake of CO2 is ocean acidification. If CO2 reacts with water this gives carbonic acid , which dissolves mostly to HCO3- and hydrogen ions H+. Thus after CO2 has been taken up by the ocean waters it will give to a smaller amount carbonic acid H2CO3 and carbonate ions CO3^2- and for the most part bicarbonite ions HCO3-. The hydrogen ions decrease the PH level – (you may sometimes find information of PH levels on your liquid soap) that is – the PH gives an indication of the concentration of hydrogen ions H+ via the concentration of Hydronium and it is thus a measure of the acidity or basicity of a solution.

Furthermore the carbonate ions CO3^2- form together with H+ again bicarbonate HCO3-. A higher concentration of H+ (“the acidity”) thus decreases the availablity of carbonate. But carbonate is necessary for producing calcium carbonate (CaCO3) which is essential for shell formation in marines organisms such as corals, shellfish and marine plankton. In other words the increasing acidification of the oceans is harmful to a lot of marine creatures. Since this process is very fast and the fast increasing acidification is clearly measurable this will lead to a rapid change in the composition of the oceans with more or less forseeable consequences. In particular it is very likely that this will have an impact on fish consumption.

update addition Jan, 28. 2017:

Here is more on how the composition of oceans may change, which indicates that at least some of the marine creatures which build shells might still keep their ability to create shells despite increasing acidification. There is a new study:

Proton pumping accompanies calcification in foraminifera (via wattsupwiththat.com) which indicates that amongst others a species called perforate foraminifera Ammonia sp. seems to be able to do so and the amount of perforate foraminifera is not too small:

“A large portion of open ocean calcium carbonate production, between 20 and 50%, derives from perforate foraminifera. Despite its clear importance for the global carbon cycle, the physiological processes responsible for calcification in foraminifera are poorly understood. The key to understanding foraminiferal calcification centres on the relation between carbon speciation in seawater and preferential uptake of these chemical species (CO2, bicarbonate and/or carbonate ions)”

The mechanism is roughly the following. Foraminifera are massively pumping protons (i.e. H+) into their local environment and so make the surrounding waters even more acidic (i.e. lower PH values). This however means that on average less CO2 is dissolved in water, i.e. some of the protons will recombine with HCO3- to H2O and CO2:

Karbonatsystem_Meerwasser_de.svg by Wikipedia User:BeAr, public domain

It seems an enzym called V-type H+ ATPase is responsible for the proton pumping.

While the protons are pushed out, there is an “inside” location in the forminifer (the socalled site of calcification (SOC)) which is less acidic and so shell formation can take place. For this the CO2 is “sucked into the foraminifer”, i.e.: “As CO2 diffuses easily across cell membranes compared to HCO3−, the large pCO2 gradient results in a flux of carbon dioxide into the foraminifer.” And so shell formation can take place at the SOC via the in the blogpost described process.

How acidic is the corresponding pumped microenvironment? The researchers write:

The foreseen reduction in pH (from 8.1 today to ∼7.8 at the end of the twenty-first century36) by increased oceanic CO2 uptake is relatively small compared with the pH decrease in the foraminiferal microenvironment (down to 6.9 in Fig. 1) during calcification.

and so

Hence, a relatively moderate decrease in pH may not impair foraminiferal calcification, especially as DIC increases at the same time. Ocean acidification may still affect calcification indirectly (for example, through altered metabolism).

where DIC is “dissolved inorganic carbon” i.e. all those bi,di, etc. carbonates.

Hence in the abstract they conclude:

…total dissolved CO2 may not reduce calcification, thereby potentially maintaining the current global marine carbonate production.

which I find a bit too optimistic in view that only between 20 and 50% calcium carbonate production derives from perforate foraminifera and not much is known about the other species apart from the fact that some seem definitely not able to maintain shell formation:

Results from culturing experiments mimicking ocean acidification showed contrasting responses of calcification: calcification was reduced in some species, whereas others were not affected.

Moreover the proton pumping mechanism may not work if acidification levels lower beyond 6.9.

Optimizing oil and gas

December 7th, 2009update 9.12.09: I just appended the above illustration to belows post and the post

before in order to draw more attention to it.

In an article “Strahlender Abfall von Öl und Gas” by Juergen Doeschner of the public TV station WDR it was reported that the Oil and Gas industry kept quiet about the problem of nuclear waste occurring in oil and gas extraction. Here radioactive waste is due to naturally occurring radioactive materials which are surfaced from subsurface formations.

citation from the article: “Strahlender Abfall von Öl und Gas”

“Der Branchenverband begründet dieses Vorgehen mit der vermeintlichen Ungefährlichkeit der kontaminierten Rückstände. “Wir haben es hier mit natürlicher Radioaktivität in einem relativ geringen aktiven Bereich zu tun, der im Bereich der natürlichen Radioaktivität auch unserer Umgebung liegt”, sagt Verbandssprecher Pick.

[Hartmut Pick, Sprecher des Wirtschaftsverbandes Erdöl- und Erdgasgewinnung (WEG)].

Diese Aussage ist falsch und widerspricht den eigenen Angaben des Verbandes. Denn danach ist die durchschnittliche Belastung der radioaktiven Öl- und Gasabfälle fast 700 mal höher als die durchschnittliche Belastung des Erdbodens. Dem WDR liegt ein Papier der Firma Exxon vor, wonach die mittlere Belastung der Abfälle sogar 3000 mal höher ist.”

translation without guarantee: The business association justifies this approach with the putative innocuity of the contaminated residues. “We are dealing here with naturally occuring radioactivity which is in the range of naturally radioactivity as it occurs in our environment.”, says spokesman of the association Pick.

[Hartmut Pick, spokesman of the business association/Wirtschaftverband Erdöl- und Erdgasgewinnung (WEG)]

This statement is wrong and it is in contradiction to the information given by the association, according to the which the average contamination of radioactive waste from Oil and Gas is about 700 times bigger than the average contamination of the soil. WDR has a document from the company Exxon, according to which the average contamination is even 3000 times bigger.

For comparision a citation from world-nuclear.org of today:

In the oil and gas industry radium-226 and lead-210 are deposited as scale in pipes and equipment. If the scale has an activity of 30,000 Bq/kg it is ‘contaminated’ (Victorian regulations). This means that for Ra-226 scale (decay series of 9 progeny) the level of Ra-226 itself is 3300 Bq/kg. For Pb-210 scale (decay series of 3) the level is 10,000 Bq/kg. These figures refer to the scale, not the overall mass of pipes or other material (cf. Recycling, below). Published data (quoted in Cooper 2003) show radionuclide concentrations in scales up to 300,000 Bq/kg for Pb-210, 250,000 Bq/kg for Ra-226 and 100,000 Bq/kg for Ra-228. In Cooper 2005, the latter two maxima are 100,000 and 40,000 respectively.

->Cooper M.B. 2003, NORM in Australian Industries, report for Radiation Health & Safety Advisory Council.

->Cooper M.B. 2005, NORM in Australian Industries – Review of current inventories and future generation, report for Radiation Health & Safety Advisory Council of ARPANSA.

I understand (?) the citation from nuclear.org as that the australian threshold for contamination with Ra-226 is 3300 Bq/kg, the found value however 250,000 Bq/kg in the first cited report or 100,000 Bq/kg in the second cited report. That would mean that the values for radium 226 (which has a half-life of 1602 years) according to these reports in hard scale are roughly 75 times or roughly 30 times higher than they should be according to australian standards.

So alone by looking at the contamination with radium it seems there is a rather expensive nuclear waste problem in the oil and gas industry. Thus as the Strahlender Abfall von Öl und Gas”-article by Juergen Doeschner also reports the radioactivity threat from this kind of waste is in Kasachstan meanwhile bigger than the threat which stems from earlier nuclear bomb tests, furthermore in the US contaminated pipes where donated to preschools and Britain is spilling its corresponding problematic waste into the north sea.

about inspection optimization in nuclear energy

December 4th, 2009In an earlier randform post about scaling factors in nuclear power generation I tried to explain what is implied if nuclear power generation is going to be increased. Among others I was talking about the risk of a nuclear accident which is going to rise by scaling things up. An important quantity in risk assessment in nuclear power generation is the core damage frequency. The corresponding Wikipedia article links to a ressource by the Electric Power Research Institute by which the probability of a damage of the nuclear core was in 2005 (i.e. the more dangerous type of fast breeder reactors, which will dominate in the future is included in this average only to a small amount) at 2*10^(-5)=0.00002 per reactor and year (there seem to be ressources which indicate that this frequency may be higher though).

This means that is if one has approx. 500 reactors worldwide the likelihood of a core damage somewhere in the world was in 2005 one damage in 100 years, if we take again a factor ten as in the randform post about scaling factors in nuclear power generation then this would rise to one core damage every 10 years. If we include an higher risk for fast breeders (which is a technology, which hasnt been tested exhaustively) then this likelihood rises again. Core damages are quite crucial because they can lead to a nuclear meltdown.

Other risks are therefore often calculated in relation to the core damage frequency. While answering to a comment about Leukemia I stumbled upon the “Studies on Applying Risk Informed In-Service Inspection for Indian Nuclear Power Plant and Heavy Water Plant” by G. Vinod from the reactor safety division at the indian Babha Atomic Research Centre in which probabilistic safety assessment techniques for indian nuclear power plants which among others are using the core damage frequency are discussed in particular with regard to optimizing inspection. A citation from the article

An optimum plan should be devised subjected to constraints such as risk to plant, cost of inspection and radiation exposure to workers, if the component is in radioactive area.

Its not clear to me to what extent inspection optimization may lead to an increase of the core damage frequency.

venice

November 29th, 2009

In the image above it looks as if a boat ferries across to Isola di San Michele. However what you see there it is just Isola di San Giorgio Maggiore. Nevertheless in Venice you may still feel as if Tadzio from the famous film may lurk around the corner any next moment.

Below I make a little advertisement for Piazza San Marco and in particular St. Mark’s Basilica since there are yet not enough tourists there…;)

microsoft patents and sparklines

November 23rd, 2009On a blog of Fabrice Rimlinger it was pointed out that a patent claim has been filed by Microsoft for a rather general class of sparklines. Sparklines is a term which was proposed by Edward Tufte in his book “beautiful evidence” as

“Intense, Simple, Word-Sized Graphics”

(citation from Edward Tufte website)

So it seems I have to pay now to Microsoft for talking about

does anyone know – do they take regular checks ?

prunn

November 16th, 2009duckking

October 28th, 2009on the return from investments

October 19th, 2009Sometimes it happens that someone says to you something occasionally – like as a side remark, but that that phrase – despite its parenthetical nature – sticks in your head. Something similar to this happened to me when an intern at a german company where I was also as a student intern said to me: Nadja – one should buy shares only with gratuitous money, never with money that one needs. Maybe this phrase stuck in my head because this person was one of the very few persons in my surroundings which knew something about the stock market, who knows. However bank accountants and other financial consultants kept telling me to care for my retirement by investing in all sorts of bonds. In view of this discrepancy of recommendations and out of curiosity I thus took part in an online game which was organized by a german public TV station (If I remember correctly WISO, ZDF).

In this game one started with a fixed virtual start amount of money which could be virtually invested in real stocks at real prices. Despite that this “stock market” was only a game it nevertheless became quite captivating. I learned a lot in this game, like that it is rather difficult to have high returns on short term investments a.s.o At the end the game became quite time consuming though. But as a result I decided to follow the advice of the person from the internship which was sound. I never owned a bond.

But this little adventure in financial markets taught me more. It made me clear that the feature of “surplus” or “gratuitous money” is quite essential. Or in other words the often proclaimed view that financial markets are democratic and open to everybody seems to be more informed by concrete interests (like to sell financial packages to laypersons) than by actual facts.

Further deduction allows to say in a simplified manner that there are the following ways to become rich (we leave marriage and adoption out): that is either by being able to “sell” highly demanded goods (like done by hollywood actors, exceptional artists, rags to riches etc.) or via owning a surplus and letting the “money work” with high returns and/or a combination of the two. Lotto wins etc. are the exception to this rule. Lets consider criminal activities also as an exception.

It is interesting to observe that the first kind, i.e. the “self-made” riches are rather accepted while the latter the “undeserved”, “lazy” riches are seen more critically. This holds especially true for the recent protagonists of the financial crisis who still – despite their obvious failures demand more returns and/or boni than what is commonly regarded as appropriate.

However it is undenied that surplusses and the rather decentralized investment of surplusses is somewhat necessary in a technological society.

High risk investments carry a high risk of failure and thus they usually carry a high risk of personal loss, so it makes sense that high risk investments usually result in higher returns than low risk investments, in order to encourage them. However meanwhile a lot of returns in the banking businesses are exorbitantly high even without any personal risk at all. Without exagerating it can be said that the whole regulating mechanism of return vs. risk seems to be out of control – at least in the banking business.

In short –it seems that the question of how to deal with surplusses and the “return of investments” is a rather crucial point in any economic discussion.

In particular, apart from the disastrous performance of the banking business, it can be said that “capitalism” hasn’t given a satisfying answer to the question of how to encourage investments into ventures with from the outset low return or even with from the outset no return at all, despite the fact that these investments are often crucial for technological and societal developments. In my eyes this is a major flaw of “capitalism” or however you wanna call the current system.

Considering the above observations I thus started to think about: How could this flaw be mitigated ? and: How can one come up with something?

Inspired by the above described game and also by games like the Sims which usually mimick a real world in a virtual environment (and where the gameplay is supported by the fact that people like to “train” for the real world) I asked myself to what extent a “new investment system” could be implemented in a game in order to test such a system for the real world. One knows that such “experiments” have limited capabilities of providing real life evidences, however they may be not completely useless. At least it seems that the new possibilities in times of MMPORGS havent been fully explored in economic science.

My question turned thus into: “How can one set up an investment scheme (in a game like environment) which encourages investments into ventures with from the outset low return or even no return?”

Assume we have a kind of Sims game that is sort of a real life economic scenario. Could it be supplied with a different system of money distribution and storage than with the usual banking and economical scheme, in particular the system should be able to encourage investments into ventures with no return, but which are desired for technological and societal reasons? If yes – What could be possible? What can one think of?

Here – a very incomplete and rough (and probably not working) scheme as a start, which is mainly intended to encourage brainstorming about these issues rather than provide a solution.

Starting from the crucial point that surplusses are needed for investments, lets assume there exists a certain amount of surplus. In the game that surplus is just a fixed start amount of extra money. In reality and within a country one could find such a surplus in all assets which are not unconditionally needed for covering the running costs. Its a debatable point what these are, but in richer countries one can find a surplus. Or coltishly put: Schloss Neuschwanstein could a priori be liquidized. In some sense a countries surplus is an indicator of how a country florishes. If there is no surplus and if even running costs cant be covered a country is usually considered to be bankrupt.

Now a surplus could be in total centrally distributed by a government. However similar real life experiments like in a centrally planned economy showed that this was economically less successful. Nevertheless it is meanwhile also rather undisputed that governments or other societal institutions should be able to exert an influence on the distribution of surplusses.

Hence lets e.g. assume that the given surplus is evenly distributed among the participants (in order to give the most democratic chance of investment and in order to mitigate the problem of lazy riches).

Impose the rule that any personal surplus has to be spend within a short time span into various (short and long term) investments (so money has to be invested). The investments have to promise “benefits” that is either one can collect benificiary points (being e.g. issued by societal institutions prior to investment) for investments into ventures with low or no return or one can collect money returns. For the work which is related to the distribution of the surplus each participant gets a “wage” which can be used for one’s own consumption. The wage is dependend on the success of the investments. If an investment yields no return or no beneficiary points or worse if even the investment is lost then the participant is “punished”. E.g. in the worst case that is if the whole surplus is lost then the participant is punished with “getting no wage from surplus”. The actual size and dependency of the wage with respect to the earned returns and/or beneficiary points is thus an important parameter.

All made returns and beneficiary points enter the personal surplus and have to be reinvested. A venture may store collected investment and eventually issue interests until the needed lump sum is collected that would accomodate for the storage effect of banks.

It may be also be good to allow only for investments which are not ones own investments. This would e.g. encourage long-term investments, since the surplus could anyways not be spend on ones own projects and thus accomodate at least partially for the intermediation function of banks.

Note that the distribution of beneficiary points is also an important parameter. (please see also this randform post about assigning values) In particular beneficiary points may be distributed to such different things as newcomer bands, extraordinary social activities/aid or research in quantum gravity.

hand from above

October 16th, 2009Hand From Above is a funny interactive installation by Chris O’Shea for BBC, Liverpool.

via ignant